China’s Secret Gold Supplier is Singapore

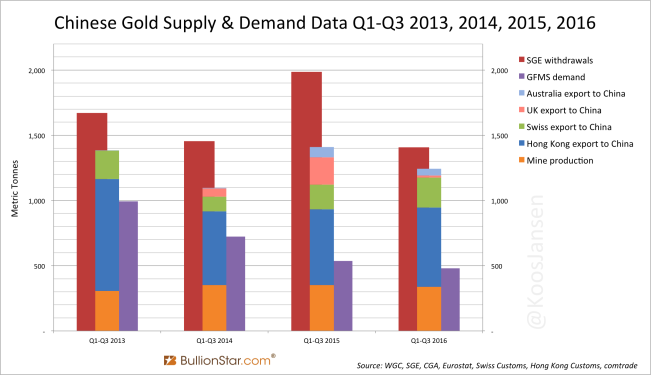

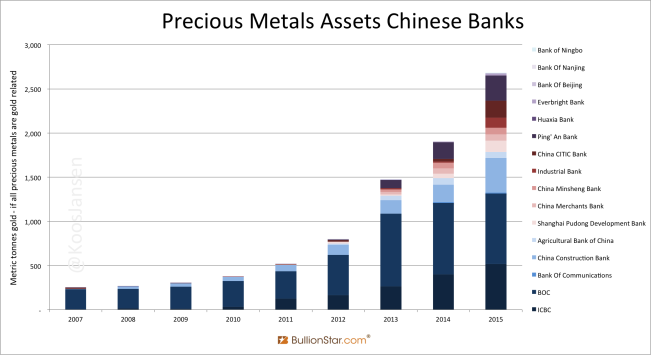

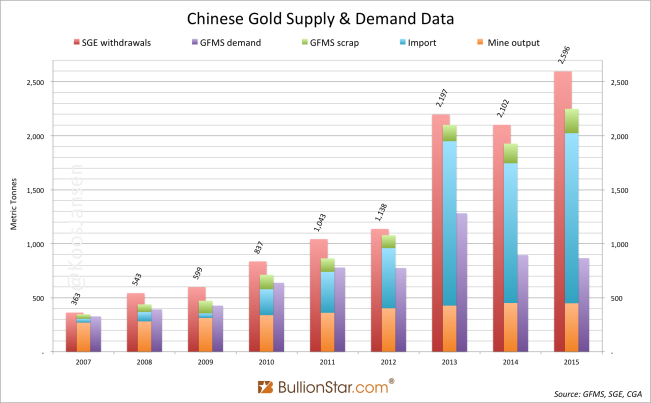

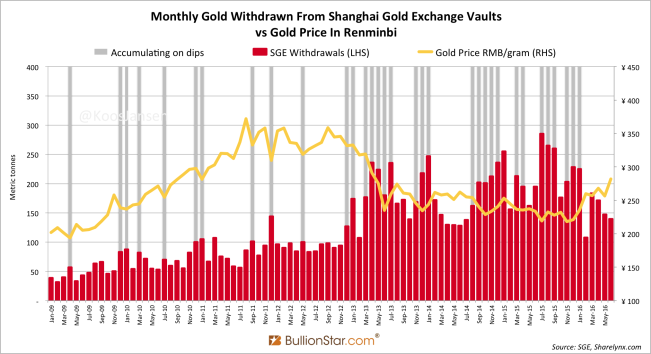

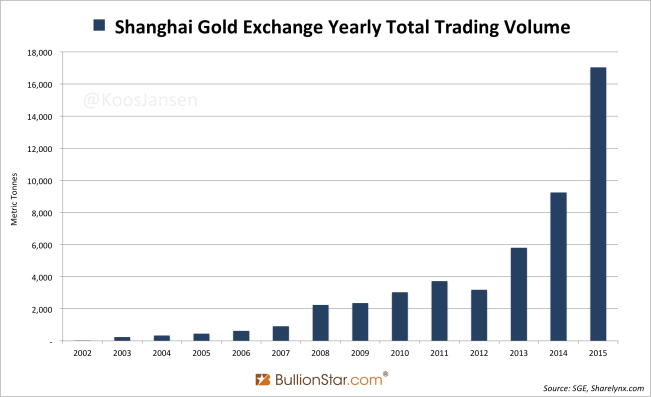

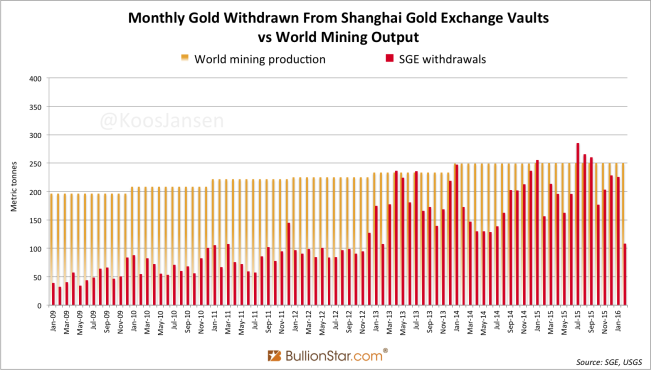

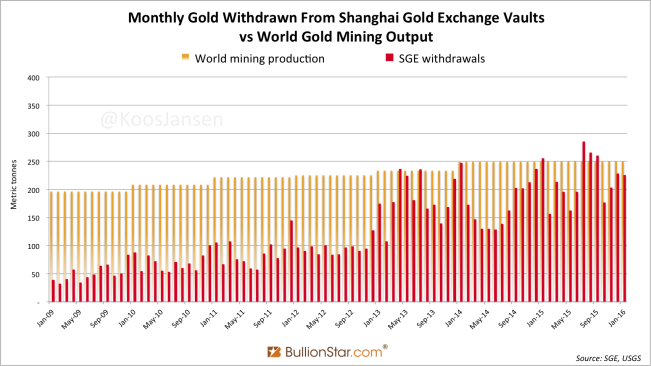

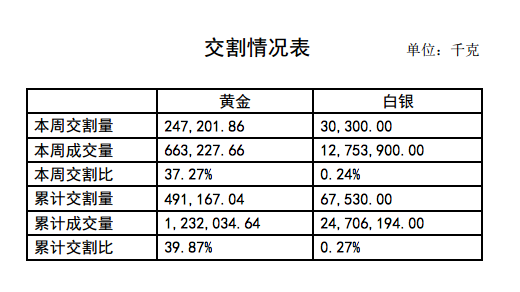

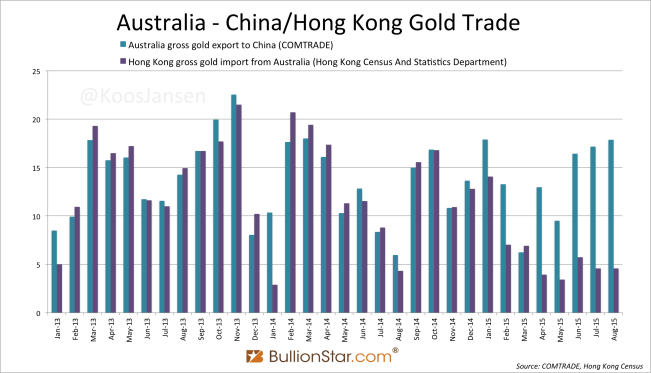

Singapore has been a major gold supplier to China since 2013, which was previously not publicly known. According to Statlink, Singapore net exported 102 tonnes to China in 2017, a record year and up 177 % from 2016. In total China net imported an estimated 1,082 tonnes in 2017, while SGE(I) withdrawals accounted for 2,030 tonnes. Continue Reading

Koos Jansen

Koos Jansen