Building a Strong Economic Security Barrier for China

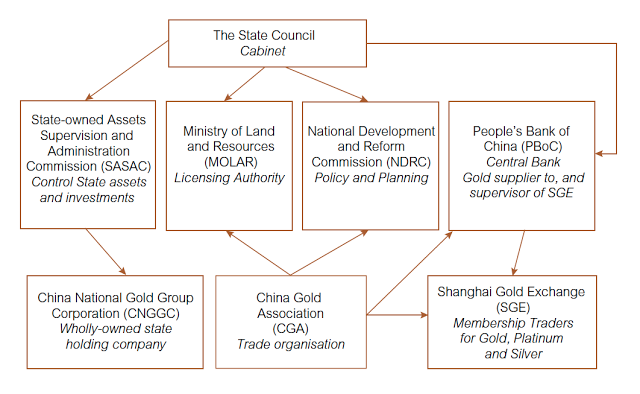

Presenting another translation of an article from one of the leaders in the Chinese gold industry. The original version appeared on 1 August 2012 in Qiushi magazine, the main academic journal of the Chinese Communist Party’s Central Committee. Sun Zhaoxue is the president of China National Gold Corporation, China’s biggest mining company. He is also president of the China Gold Association, that acts as a bridge between the Chinese government and gold producers in protecting business interests and providing information, consultancy, co-ordination and intermediary services for them. In the article he explains that China needs to hoard gold in order to safeguard the country’s economic stability and to strengthen its defense against external risks.

In 2011 Sun received the award economic person of the year on state television channel CCTV, as you can see in this video (opens in new window). Watch how the show, broadcasted on prime time with orchestral music, moving camera’s and women in cocktail dresses, emphasizes the importance of gold and glorifies the guy digging it up. In his acceptance speech Sun said the price of gold will rise and China should seize the opportunity to act accordingly.

Although other sites (ie the Financial Times) have quoted from Sun’s oncoming article, none of them published the whole thing. This MUST READ is translated for us by Soh Tiong Hum (click for his very interesting +Google page).

the state will need to elevate gold to an equal strategic resource as oil

Building a strong economic and financial security barrier for China

– Actively build and implement national gold strategies

Published 1 August 2012, Author: SUN Zhaoxue

Because Gold possesses stable intrinsic value, it is both the cornerstone of a countries’ currency and credit as well as a global strategic reserve. Without exception, world economic powers established and implement gold strategies at the national level. China is the world’s second largest economy, in order to enhance core competitiveness in a shorter period of time, an important aspect is an integrated policy of gold exploration, production, trade, consumption and investment so as to strengthen China’s control of this strategic resource, thereby effectively safeguard the country’s economic and financial security in the process of globalization and strengthen defense against external risks.

First, rediscover the status and role of gold reserves from a strategic height

After the disintegration of the Bretton Woods system in the 1970s, the gold standard which was in use for a century collapsed. Under the influence of the US Dollar hegemony the stabilizing effect of gold was widely questioned, the ‘gold is useless’ discussion began to spread around the globe. Many people thought that gold is no longer the monetary base, that storing gold will only increase the cost of reserves. Therefore, some central banks began to sell gold reserves and gold prices continued to slump. Affected by this point of view, the growth of gold reserves for China, the world’s largest gold producer, began to slow.

Indeed, since mankind’s discovery of gold, gold because of its stability and rarity became mankind’s important method of exchanging labor and wealth. Along with the deepening of economic globalization gold stabilized societies and economies, prevented inflation, increased national credit-worthiness and stabilized exchange rates. It possesses a status that is irreplaceable by other capital assets. Especially since the outbreak of the international financial crisis, gold’s safe-haven against inflation is increasingly prominent, its strategic position in the reserves of wealth regained world attention and central banks became net buyers of gold.

Currently, there are more and more people recognizing that the ‘gold is useless’ story contains too many lies. Gold now suffers from a ‘smokescreen’ designed by the US, which stores 74% of global official gold reserves, to put down other currencies and maintain the US Dollar hegemony. Going to the source, the rise of the US dollar and British pound, and later the euro currency, from a single country currency to a global or regional currency was supported by their huge gold reserves.

Especially noteworthy is that in the course of this international financial crisis, the US shows a huge financial deficit but it did not sell any of its gold reserves to reduce debt. Instead it turned on the printer, massively increasing the US Dollar supply, making the wealth of those countries and regions with foreign reserves mainly denominated in US Dollar quickly diminish, in effect automatically reducing their own debt. In stark contrast with the sharp depreciation of the US Dollar, international gold price continue to rise breaking $1900 US Dollars per ounce in 2011, gold’s asset-preservation contrasts vividly with the devaluation of credit-based assets. Naturally the more devalued the US Dollar, the more the gold price rises, the more evident the function of US gold reserves as a hedge. Although the international financial crisis was established in the US, the crisis failed to shake the dollar’s status as an international currency. US net wealth did not appear to diminish with the same degree of the dollar’s decline, an important reason why the US’ 8,133 tons of gold reserves play a role. In the global financial crisis, countries in the world political and economic game, we once again clearly see that gold reserves have an important function for financial stability and are an ‘anchor’ for national economic security.

After 30 years of reform and development, China has become a highly open country, not only moving in tandem with the world economy, but is playing an increasingly important role in the way the setup of the world economy changes. Therefore to win over new changes and challenges in the international post-crisis era, China must not only advance the internationalization of the Chinese RMB supported by a massive economy, but also view gold reserves as an important parameter and achieve a logical ratio between gold reserves and economic output. This requires us to make a forward looking judgment on the scale of gold reserves, build and implement quickly a national gold strategy that is suitable to China’s economic development.

Second, effort to increase domestic resource integration is our main channel to increase gold reserves

Due to China’s huge forex reserves, it’s difficult in the short term to make gold a main channel to accumulate forex reserves like the US and European countries. It’s especially true that as global gold prices make new highs, increasing gold reserves also become more difficult [Author includes an idiom ’风物长宜放眼量’ from Mao Zedong here; idiom says that there are many setbacks and frustrations in life but one should adopt a long-term horizon to analyze a problem in order to find solutions]. We need to establish a more clear national gold strategy, look at benefits over a long term as a starting point, amply make use of two markets, two resources, continue to grow gold reserves and progressively become a ‘gold-reserve’ nation that is commensurate with the country’s economic strength. Based on current conditions, apart from accumulating gold from international markets at opportune moments, the main channel to implement a national gold strategy is to increases domestic gold integration through increasing gold production, this in order to strengthen the all-round development of China’s economy and financial ‘breakwater’.

Due to China’s huge forex reserves, it’s difficult in the short term to make gold a main channel to accumulate forex reserves like the US and European countries. It’s especially true that as global gold prices make new highs, increasing gold reserves also become more difficult [Author includes an idiom ’风物长宜放眼量’ from Mao Zedong here; idiom says that there are many setbacks and frustrations in life but one should adopt a long-term horizon to analyze a problem in order to find solutions]. We need to establish a more clear national gold strategy, look at benefits over a long term as a starting point, amply make use of two markets, two resources, continue to grow gold reserves and progressively become a ‘gold-reserve’ nation that is commensurate with the country’s economic strength. Based on current conditions, apart from accumulating gold from international markets at opportune moments, the main channel to implement a national gold strategy is to increases domestic gold integration through increasing gold production, this in order to strengthen the all-round development of China’s economy and financial ‘breakwater’.

In the new century, under the guidance of systematic development, China’s gold industry ushered in a period of accelerated development and in one fell swoop got rid of the ‘poor gold country’ hat. From 2007 to 2011, China’s gold production took global pole position and established a complete industrial system of gold, effectively supporting the national gold strategy. There are still many shortcomings in our current gold industry, particularly prominent problems include: generally small scale mining, low proven reserves, unconsolidated mining concessions, recovery of mining by-products, development order, environment protection and other aspects of uneven development. Statistics show that there were more than 500 Chinese regions that mine gold in 2011, making up more than 700 gold mines, yielding an average of 0.5 tons per mine. The world’s largest gold producer Barrick Gold Corporation of Canada produced 239.5 tons however.

To address this situation, China is also increasing gold resource integration efforts in recent years. However, due to long-standing lack of development of gold resources on strategic planning, and in recent years an illusion of wealth brought by the gold bull market, a variety of aspects of social capital have been involved in mining. To fundamentally solve these problems, the state will need to elevate gold to an equal strategic resource as oil and energy, from the whole industry chain to develop industry planning and resource strategies. First, we must restrict access, from a technical, financial, security and environmental protection perspective, to improve the access threshold for exploration of gold. To raise the barrier of entry will gain the efficiency of mining. Second, to further improve mining management we must increase resource integration efforts, further develop and expand main gold exploration and development companies into leading enterprises, so as to achieve projects of scale. Third we should encourage key enterprises that are competitive to penetrate globally so as to avoid loss of bargaining power, because domestic enterprises consist of small players.

In addition, because individual investment demand is an important component of China’s gold reserve system, we should encourage individual investment demand for gold. Practice shows that gold possession by citizens is an effective supplement to national reserves and is very important to national financial security. World Gold Council statistics show that Chinese individuals possess less than 5 grams of gold per capita, a significant difference to the global average of more than 20 grams. This shows that there big potential for private ownership.

Third, committed to the promising and rigorous implementation of the national gold strategy

Formed in early 2003, China Gold Group Corporation is both China’s largest gold production and sales enterprises, but also the gold industry’s only state owned enterprise. Under the direction of scientific development [this term appears several times – it can mean using a systematic approach or can also refer to a government directive] over the past 10 years, China Gold Group Corporation always adhered to building an excellent business, preventing financial risks and servicing the national situation as a top priority China Gold is committed to promote the coordinated development of gold industry’s exploration, mining, processing, consumption and investment in the industrial chain for a healthy development of China’s gold market, in order to contribute to the effective implementation of the national gold strategy. In 2012, China Gold Group Corporation’s total assets will exceed more than ¥60 billion yuan, sales revenue will exceed ¥100 billion yuan. Currently, the Group has a daily processing capacity of 150,000 tons of ore, business scope covers the entire value chain and has grown into China’s gold industry leader. The group has to play a leadership role as state-own enterprise, to turn the gold industry into an important pillar of stable national economic growth under the national gold strategy.

In the “Twelve Five" period [abbreviation for central policy 5-year plan; 12-5 is the plan for period 2011-2015] we will target the gold industry with cutting-edge technology and continue to increase investment in science and technology for the implementation of a technology driven strategy to promote the optimization and upgrading of the gold industry. At present China Gold Group Corporation has three R&D projects incorporated into the “Twelve Five" National Science and Technology Support Program, appointed by the Ministry of Science to be a green gold mining technology feasibility study project.

The company plays a major role in promoting large-scale research projects. Through independent innovation and integrated innovation we address the constraints of gold exploration, mining, smelting and other areas of industry challenges, and continuously improve the comprehensive development and utilization of mineral resources capability. Meanwhile, we should focus on projects as an opportunity to revitalize the national equipment manufacturing industry as its mission, find ‘win-win’ models of cooperation for mining companies and equipment manufacturers, actively support localization of major equipment to promote the continuous innovation of major mining equipment producers.

To bear national responsibility and increase national gold reserves in the “Twelve Five" period, China Gold Group Corporation must firmly grasp the lifeline of resources with methods such as exploration to increasing proven reserves, merger and acquisition, base construction and opening up offshore gold resources to accelerate increase of national gold reserves. On the one hand, we should make full use of own research and manpower, increase number of talents, funds and equipment to carry out prospecting, achieve the highest gold reserves in the shortest time; on the other hand actively secure local government support to increase regional integration, breakthroughs, scientific development, achieving higher efficiency, to solve the gold industry’s problem of being resource-inefficient and environmentally destructive because of mining small, scattered, isolated, far’. In the near term, China Gold Group Corporation will, on the 20 national regions identified for gold production, speed up consolidation of small mines into a batch of technologically-advanced, environmentally friendly, ‘role-model’ enterprises that can produce 3-8 tons annually. Concurrently, actively implement a globalization strategy that will exploit overseas resources and increase channels to grow China’s gold reserves.

We should advocate to ‘store gold among the people’ and guide a healthy positive development in this segment. In recent years, the domestic gold industry’s rapid growth provided good conditions for various uses of gold, as well as create space for this business to grow faster. China Gold Group Corporation has to catch the opportunity, while increasing its supply capacity, to push ‘store gold among people’ strategy, actively extend the business value chain, increase gold investment types, encourage and promote individuals’ gold investment and consumption. Foremost, maximize the utilization of nearly 1600 China Gold retailers, increase sales channels, optimize sales network, strengthen branding and achieve to ‘store gold among the people’ and thus ‘store wealth among the people’. This is the objective under our gold strategy.

World economies are shaken and insecure, causes of instability are coming together and uncertainty is growing. The world economy faces new changes, new challenges and new opportunities, therefore we must relook the status and function of gold from a strategic height and create and implement a national gold strategy, to strengthen our country’s ability to counter complex situations. This is the only way for China’s gold industry to adopt a scientific evolution, to push China from across the milestone from a ‘large gold country’ to a ‘strong gold country’.

(Author : China Gold Group Corporation General Manager, President of China Gold Association)

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen